The Indian government has taken a significant step toward Vizag Steel Plant Revival, also known as Rashtriya Ispat Nigam Limited (RINL), with an equity infusion of Rs 11,440 crore.

This move is aimed at sustaining operations and stabilizing the financial health of the state-owned steel company, which has been grappling with mounting debts and operational challenges.

Background and Financial Crisis

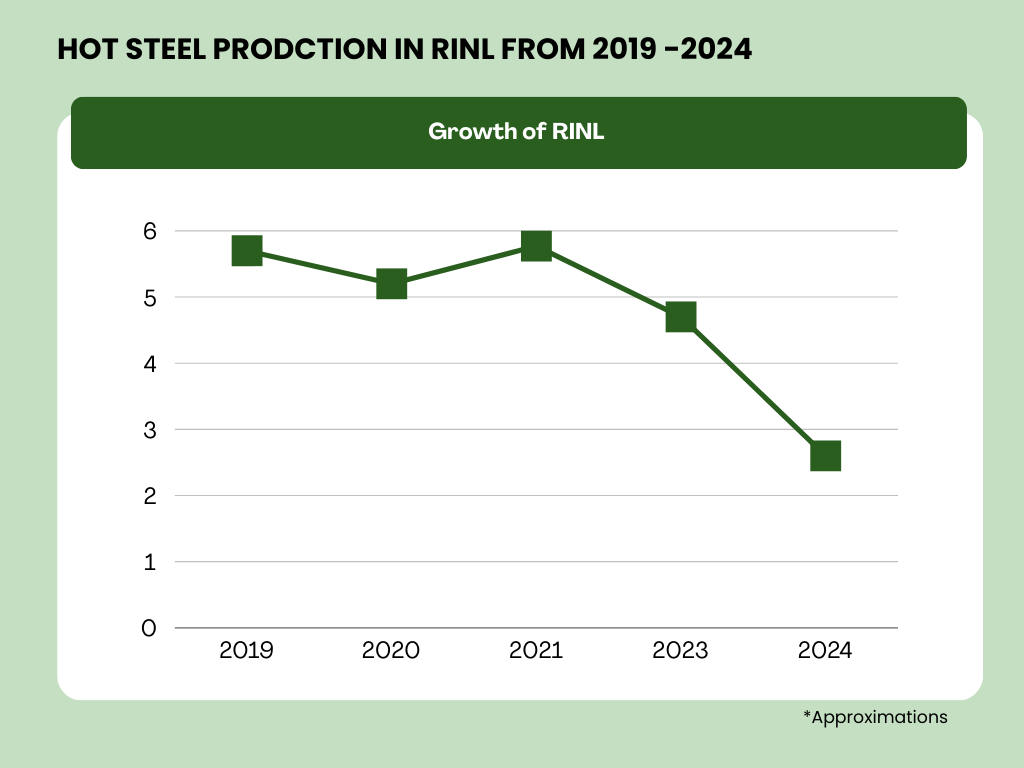

RINL, a Schedule-A Central Public Sector Enterprise (CPSE) under the Ministry of Steel, operates the Visakhapatnam Steel Plant (VSP) with an installed capacity of 7.3 million tonnes per annum (MTPA) of liquid steel.

Despite its strategic importance, RINL has been facing severe financial distress over the past few years due to high production costs, inefficient capacity utilization, and market fluctuations.

As of March 31, 2024, RINL reported a negative net worth of Rs (-) 4,538 crore. Its current assets stood at Rs 7,686.24 crore, while liabilities soared to Rs 26,114.92 crore.

The company had already exhausted its sanctioned working capital limits from banks and defaulted on capital expenditure (capex) loan repayments and interest payments in June 2024.

Details of the Revival Plan

The revival plan, approved by the Cabinet Committee on Economic Affairs (CCEA) in January 2024, includes a structured capital infusion of Rs 11,440 crore:

- Rs 10,300 crore as equity capital – Direct equity infusion to strengthen the company’s balance sheet and improve liquidity.

- Rs 1,140 crore as preference share capital – Conversion of existing working capital loans into 7% Non-Cumulative Preference Shares, redeemable after 10 years.

The capital infusion is expected to improve RINL’s financial standing, enabling the company to meet operational expenses, address outstanding debts, and restore production capacity.

Government’s Strategic Intent

Minister of State for Steel Bhupathiraju Srinivasa Varma confirmed that the revival plan aligns with the objectives of the National Steel Policy, 2017.

The policy focuses on enhancing domestic steel production, improving operational efficiency, and reducing reliance on imports.

“The company has focused on improving techno-economic performance, better capacity utilization, and rationalization of fixed costs to enhance operational efficiency,” said Varma in a written statement to the Rajya Sabha.

Challenges Ahead

Despite the capital infusion, RINL faces several challenges:

- High production costs – RINL’s cost of production remains higher than private competitors due to outdated technology and higher input costs.

- Debt servicing – While the preference share capital infusion will ease immediate liquidity concerns, long-term debt restructuring remains critical.

- Global market pressures – Fluctuations in steel prices and global demand could impact profitability.

- Operational efficiency – Improving production efficiency and reducing wastage will be key to sustaining long-term profitability.

Outlook

The Rs 11,440 crore capital infusion marks a crucial step in RINL’s recovery journey.

While the immediate goal is to stabilize operations and improve liquidity, the long-term success of the revival plan will depend on strategic reforms, cost optimization, and possibly leveraging private sector expertise.

Vizag Steel Plant Revival could strengthen India’s domestic steel production capacity, align with the “Make in India” initiative, and position RINL as a competitive player in the global steel market.

Also read: RINL: The untold story

Stay tuned to Yo! Vizag website and Instagram for more related updates.

Discussion about this post